- Slight sales reduction of 4% (currency adjusted) to CHF 1011 million in demanding markets with a bright spot in the USA Architecture business

- Improved adjusted EBITDA to 91 million (+3%) at a margin of 9.0% (PY 8.4%)

- Group-wide “Accelerate” performance and innovation program executed with costs of CHF 22.5 million to generate yearly run-rate savings of CHF 10 million

- Strong free operating cash flow of CHF 57 million (+42%)

- Solid balance sheet with equity ratio of 67%

- Consistent dividend of CHF 15 per registered share proposed

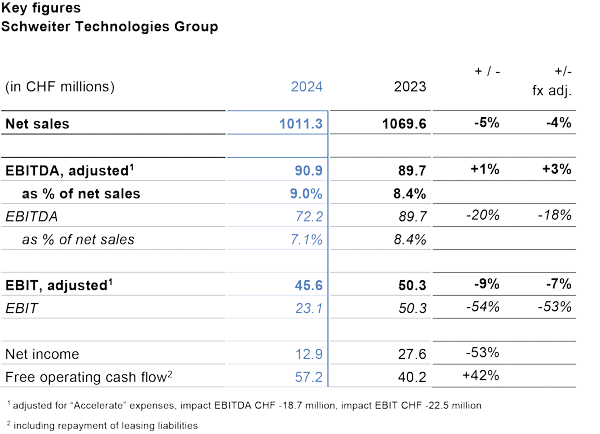

Net sales fell by 5% to CHF 1011.3 million (previous year: CHF 1069.6 million) respectively 4% currency adjusted. Despite lower volume, the adjusted EBITDA rose by 3% to CHF 90.9 million (previous year: CHF 89.7 million) and the corresponding margin increased to 9.0% (previous year: 8.4%). The adjusted EBIT reached CHF 45.6 million (previous year: CHF 50.3 million) with a margin of 4.5% (previous year: 4.7%). Net income fell to CHF 12.9 million (previous year: CHF 27.6 million) caused by the one-time cost impacts of CHF 22.5 million related to the “Accelerate” performance and innovation program. Operating free cash flow of CHF 57.2 million showed an increase by 42% (previous year: CHF 40.2 million), mainly thanks to a strong focus on net working capital improvements and lower capex spending. The net cash position improved to CHF 51.5 million. The balance sheet remains solid with an equity ratio of 67%. The Board of Directors will propose a consistent dividend of CHF 15 per registered share at the Annual General Meeting on 9 April 2025.

BUSINESS PERFORMANCE IN 2024

The markets were impacted by demanding conditions throughout the year. Geopolitical uncertainties in many countries created muted investment and consumer sentiment and the economic weakness in Europe continued driven by high interest rates. This led to lower net sales compared to the previous year. The focus in 2024 was on the execution and completion of the performance and innovation program “Accelerate”. It optimized the production footprint by closing sites and by cost reductions across all entities. Further, the Group concentrated the efforts to automate new production lines and to bring innovations faster to the markets. The “Accelerate” program came with one-time costs of CHF 22.5 million to generate run-rate savings of around CHF 10 million, effective in 2025 already.

The Display business performed quite resiliently, both in Europe and North America. The business in Europe though witnessed high raw material price volatility. Particularly in the second semester, abrupt clear-sheet raw material price declines led to temporarily limited sales to the distributors. New products were launched in 2024 to strengthen the sustainable and profitable product offering and to transform the product portfolio. In Europe, the house of brands has been expanded with products based on up to 100% recycled materials under the brand addition “RE”. In North America, a new extremely flat high-performance foam board was launched, delivering striking digital print results, and broadening the offering in the attractive visual communication market.

Results of the Core Materials business were subdued. The wind energy market was impacted by PET overcapacities in China, resulting in price erosion and by slow project approvals in Europe. On the other hand, encouraging demand was witnessed in North America and the business capitalized on its kitting operations. Activities in the marine and technology segments were expanded emphasizing the strategic direction. Further, the balsa business performed well for wind and non-wind applications.

A bright spot in the business portfolio was the Architecture business. It was growing mid-single digits although at different rates globally. The North American business recorded strong results benefitting from the strong economy, building on the premium brand ALUCOBOND® and it successfully penetrated the new markets of residential construction as well as the interior building markets with easy to apply innovative solutions. The European business was impacted by weak economic construction market conditions. The smaller business in Asia suffered from a shrinking market in China while markets in India and Middle East performed with positive dynamics.

The Transport and Industry business generated weaker results. Demand for industrial thermoforming solutions and for rail and road markets experienced notable slowdowns. Hence the company focused its efforts on the “Accelerate” footprint optimization and on developing new product innovations for enhanced, functional performance materials.

OUTLOOK FOR 2025

The year 2025 started with a continuation of geopolitical and economic uncertainties. Driven by market share gains through innovation and market penetration, a stable net sales development is expected for the full year with a weaker first semester and some recovery in the second half of the year. The Display business should develop quite resiliently, both in Europe and North America, and it will further progress with its product portfolio transformation. The Core Materials business, still confronted by tight competition and price pressure, is expected to gain market share in wind and non-wind applications with its competitive product range of PET and balsa wood in particular. Opportunities are intact in the Architecture business in North America and geographical expansions in China and India will enable to reach a broader customer base, though weak construction markets will persist in Europe. Improved profitability is targeted in 2025 driven by the realization of the “Accelerate” measures and continued strong focus on operational excellence measures. Customers will continue to profit from the consequent realization of the claim “Making life lighter and more colorful", this will also fuel the portfolio transformation by innovation.

FINANCIAL CALENDAR 2025

• Annual General Meeting: 9 April 2025, Zug

• Half-year results: 25 July 2025 (webcast only)

The 2024 Annual Report and the investor presentation are available on the website at www.schweiter.com. A media conference on the 2024 annual results will take place for analysts, media representatives, and investors at the Marriott Hotel, Neumühlequai 42, Zurich, today at 11.00 a.m. and will simultaneously be transmitted in a webcast.

For further information please contact:

Urs Scheidegger

Group CFO

Tel. +41 41 757 77 00

investor@schweiter.com