▪ Slight uptick in EBITDA margin 8.8% (PY 8.7%) despite lower volume

▪ Net income of 12.8m (-37%) mainly due to FX headwinds

▪ Group improves margin profile by divesting non-core Bus & Rail unit

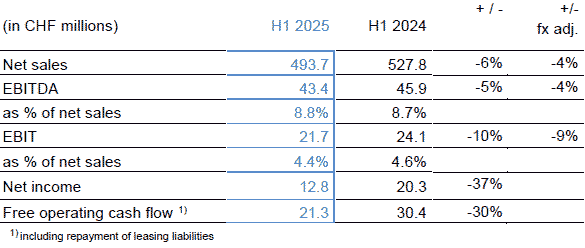

Steinhausen, 25 July 2025 – In persistently demanding market environments Schweiter Technologies generated net sales of CHF 493.7 million, a year-on-year decrease by -6% (-4% after currency adjustments). Solid growth for the Core Materials solutions globally and for the Architecture solutions in Europe and Americas was offset by soft end-markets in Display Europe and Americas. The Group achieved EBITDA of CHF 43.4 million or 8.8% of net sales (previous year: CHF 45.9 million; 8.7%). The measures implemented with the “Accelerate” program to increase efficiency and reduce costs proved effective and the relative operational profitability was enhanced despite lower sales volumes and net sales. EBIT came to CHF 21.7 million (previous year: CHF 24.1 million). Net income at CHF 12.8 million (previous year: CHF 20.3 million) reduced mainly due to the lower operating result and unfavorable currency impacts based on the very strong Swiss franc. The free operating cash flow reached CHF 21.3 million (previous year: CHF 30.4 million).

BUSINESS PERFORMANCE, FIRST HALF OF 2025

Despite the market-related drop in sales, 3A Composites was able to slightly improve the EBITDA margin. The Americas region reported net sales growth on currency adjusted basis, driven by the Architecture and the Core Materials businesses, while Europe was confronted with a persisting challenging economic environment and only Architecture showed growth. Business in the Asian markets grew on Core Materials while the Architecture business declined due to the strained property developments market in China.

KEY FIGURES FOR SCHWEITER TECHNOLOGIES GROUP

The Display business generated lower sales and profitability in both key markets of Europe and North America despite persisting high customer interest for the product portfolio transformation and the ever growing offering of more sustainable products. Overall, net sales reduced compared to the resilient prior year reference due to soft demand in the Visual Communication market largely on the back of reducing raw materials prices, particularly for acrylics in Europe. On this background, distributors did not replenish their stocks but were rather prudent in a wait-and-see attitude, predominantly for clear sheets. A strong cost focus, digitalization efforts, and benefits from the “Accelerate” program contained the profitability reduction.

The Architecture business recorded slightly higher net sales and a rise in profitability compared to the prior year reference. Solid growth was recorded in North America and Europe while Asia/Pacific declined. North America continued its strong track record and further penetrated into the multi-family homes market. Demand in Europe increased on the low prior year baseline while in Asia/Pacific sales were below expectations due to low volumes in China, where strong efforts are in execution to strengthen and expand the distributor network to broaden the project pipeline. Very strict cost discipline across all locations supported a profitability increase.

End market dynamics of the Core Materials business corresponded with expectations and were marked with headwinds in the wind business on the regulatory front mainly in USA and China, and by manufacturing challenges at key OEM customers. Overall sales were nevertheless above prior year level with solid sales to wind customers and a strong business performance with balsa solutions. This compensated lower demand in the non-wind business with a subdued marine market, and the sales price pressure in China. Strong cost focus, innovation, and efficiency gains supported the profitability increase compared to previous year.

The Transport & Industry business witnessed strong customer interest in its innovative new solutions such as Durolen®, a thermoformable sheet with exceptional impact performance. Overall customer demand however persisted subdued and generated lower net sales compared with prior year. A weak economic momentum coupled with customer-induced output delays in the segments road and rail drove down net sales and profitability.

GROUP DIVESTS ITS NON-CORE BUS & RAIL BUSINESS

The Group today announces that it has signed a binding agreement to divest its Bus & Rail (Mobility) business unit to the financial investor “Hypax”, the Berlin and London-based investment firm focused on corporate carve-outs and operational improvement. The closing is expected by July 31 subject to closing requirements. Hypax is taking over all employees and commercial contracts and is highly committed to the future growth of the Bus & Rail (Mobility) unit.

This divestment streamlines the Group’s business portfolio and further aligns it with its sharpened strategy to focus on its core businesses of lightweight composite solutions. The Bus & Rail (Mobility) unit operates independently of the Group’s core operations and is specialized in particular technologies and applies a distinctively different go-to-market access.

The Bus & Rail (Mobility) unit represents about 3% of the Group’s net sales and occupies some 300 employees in two sites in Switzerland and Poland. The unit has a strong position in the Bus & Rail segment in Europe, but it increasingly faced competitive headwinds. The Group will recognize a non-cash book loss of about CHF 26 million, mainly driven by depreciation of intercompany loans, in the Full Year 2025 financial statements. On the other hand this transaction improves the Group’s margin profile to achieve its profitable growth targets and to increase free cash flow generation.

OUTLOOK FOR SECOND HALF OF 2025

Several end market dynamics are currently challenging and difficult to predict. The subdued consumer sentiment in Europe is expected to continue, shy improvements compared to the first half year are however projected across all European businesses. Demand in North America is expected to continue strong in Architecture and to remain flattish for the Display business. The Asia/Pacific Architecture business as well as the global Core Materials business are expected to continue on current sales levels.

Schweiter Technologies expects the net sales trend for the year to be slightly negative currency adjusted. The Group anticipates an incremental improvement in profitability in the second half year driven by the realization of “Accelerate” savings and the deconsolidation of the Bus & Rail business.

FINANCIAL CALENDAR

• Publication of annual results 2025: February 27, 2026

• Annual general meeting: April 9, 2026

The complete Semi-Annual Report for 2025 can be found on our corporate website www.schweiter.com.

An investor, analyst and media webcast on the 2025 half year results will take place today at 11.00 a.m.

For further information please contact:

Urs Scheidegger

Group CFO

Tel. +41 41 757 77 00

investor@schweiter.com